santa clara property tax due date

Taxing authorities include Santa Clara county governments and. Actually tax rates mustnt be increased before the general public is previously.

What You Should Know About Santa Clara County Transfer Tax

E-Filing your statement via the internet.

. SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes. The bills will be available online to be viewedpaid on the same day. MondayFriday 800 am 500 pm.

The County of Santa Clara assumes no responsibility arising from use of this information. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021. ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or.

Standard Data Record SDR. The bills will be available online to be viewedpaid on the same day. MondayFriday 900 am400 pm.

The Department of Tax and Collections in. If the due date on the bill falls on Saturday Sunday or a County holiday payments. County of Santa Clara Department of Tax and Collections - Property tax frequently asked questions.

All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. Ad View Property Appraisals Deeds Structural Details for Any Address in Santa Clara. There are three vital phases in taxing property ie devising mill rates appraising property values and receiving tax revenues.

In establishing its tax rate Santa Clara must respect Article VIII Sec. Last Payment accepted at 445 pm Phone Hours. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners.

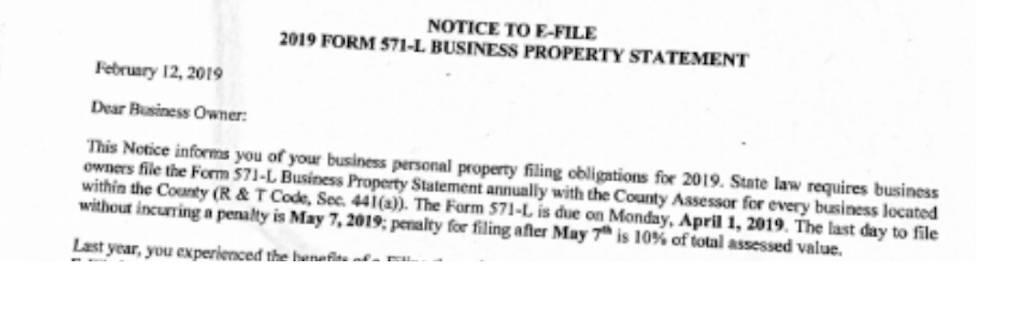

Standard paper filing 3. Send us a question or make a comment. There are three ways to file the Business Property Statements 571-L 1.

Owners must also be given an appropriate notice of rate. This tax payment is based on property values determined for the January lien date 15 months earlier. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022. Last day to file a business personal property statement without. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

21 a of the Texas Constitution.

What Can You Do About Your California Property Tax Payment Covid 19 S Impact On California Property Tax Deadlines And Planning Considerations Inside Salt

Santa Clara County Property Taxes Due Date Ke Andrews

571 L Sf Property Tax Statements For California Startups

Property Tax Update No Penalties On Unpaid Second Installment Of Property Taxes County Of Santa Clara Mdash Nextdoor Nextdoor

California Property Tax Calendar Escrow Of The West

University Area Enforcement City Of Santa Clara

Scam Alert County Of Santa Clara California Facebook

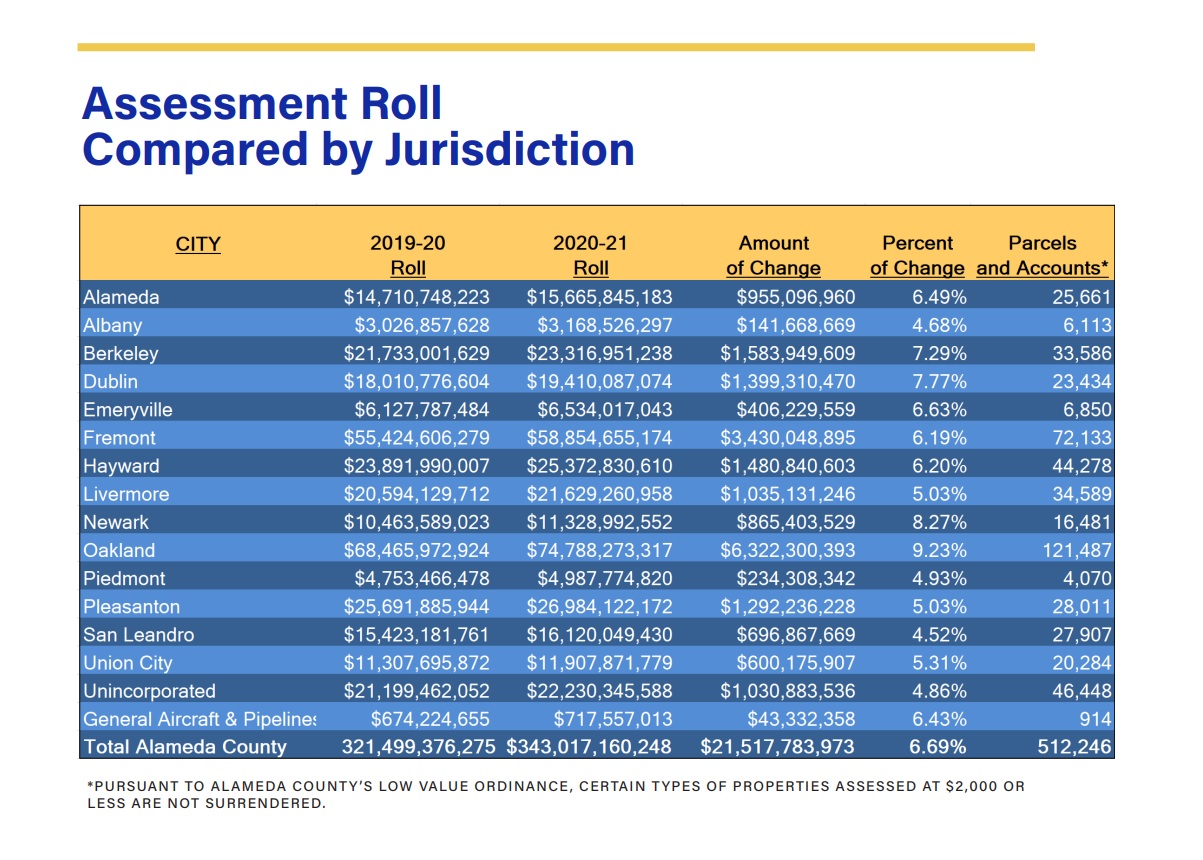

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Taxes Department Of Tax And Collections County Of Santa Clara

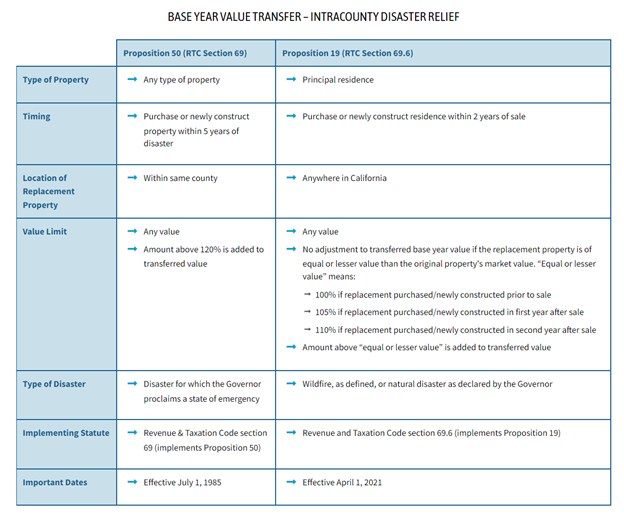

Prop 19 Property Tax And Transfer Rules To Change In 2021

Santa Clara County Assessed Property Values Rose 43b In 2021 Silicon Valley Business Journal

Secured Property Taxes Treasurer Tax Collector

28 451 93 Reasons We Made This Client Smile Shannon Snyder Cpas

Property Owners In Santa Clara County Are Eligible For Tax Bill Relief

Santa Clara County Assessed Property Values Rose 43b In 2021 Silicon Valley Business Journal